Speed up

applications

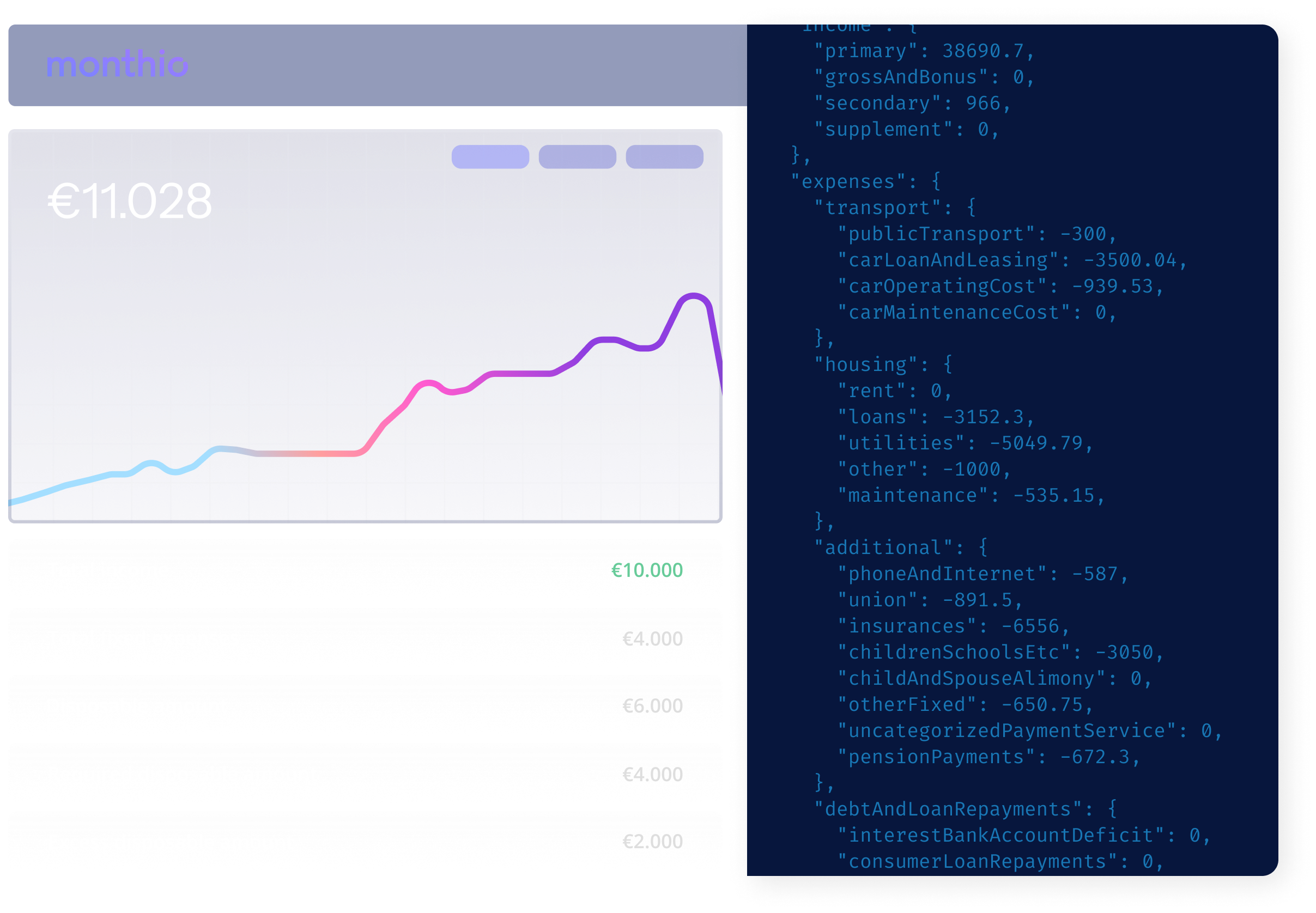

Accelerate your loan application process from days to minutes with Monthio's income verification. Monthio collects and crunches PSD2 as well as additional financial data, providing you with immediate and precise insights to make informed credit decisions.